“For the robust, an error is information,” Nassim Nicholas Taleb

The Vanguard Capital Markets Model® currently projects S&P 500 annualized returns of 5% over the next decade. This compares poorly with the historical 10% average annual return for the index. To make matters worse, expected volatility is still unchanged at 17%. While risk is projected to be the same for investors, returns are expected to be half as good.

Why does Vanguard expect returns between 2023 and 2033 to be worse than average? Because valuations are elevated. Any measure you scrutinize that has demonstrated predictive power is currently priced materially higher than average: price-to-sales; market cap-to-GDP; Shiller’s Cyclically Adjusted Price-to-Earnings Ratio (CAPE); etc.

But does this information about the future help us in the short term?

“Valuations… are not predictive over the shorter term. Yes, over the long run valuations are predictive of performance. But you can have extended valuations for an extended period of time. And the reality is that the biggest issue most investors face is not participating in the equity market,” Kristina Hooper, Invesco, Chief Global Strategist on Blomberg Surveillance 1/20/20

Conventional Wall Street wisdom, we’ll let you be the judge of what that is worth, says that long-term forecasts tell you nothing about the short term. At MKAM ETF we see things differently.

How can we have useful models that forecast performance a decade from now, but tell you nothing about the short or intermediate term? After all, to get to 2032, you travel through 2024, 2025, 2026, etc. We believe that the journey you have already partially completed informs the rest of the trip.

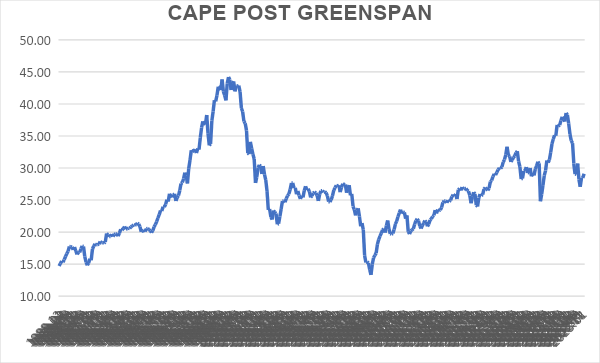

Consider that five years ago, Shiller’s CAPE was 31.2. This is higher than the CAPE that has warranted the historical average of 10% per year annualized returns the S&P 500 has averaged over time. Further, it was above the 26.1 average in the post Greenspan era, from 1988 through today. It would be reasonable to expect the next decade of returns to be lackluster for investors who paid a premium to own stocks on May 31, 2018.

Source: Robert Shiller

Contrary to expectations, the S&P 500 has generated 11% per year returns since then, even higher than the historical average. In fact, in just five years, the S&P 500 has already earned all the returns the CAPE model forecasted over the next decade, given its starting valuation. The next five years must generate negative returns for the prediction of five years ago to prove accurate. To us, the error of the previous forecast is not wrong, it is useful information.

A similar analysis of CAPE predictions of 7, 8, and 9 years ago leads you to the same conclusion. The S&P 500 has already pulled forward future returns into what is now the past. In a world where investors can get 5% returns on their cash, it seems prudent for risk-conscious investors to reduce their exposure to the S&P 500.

MKAM ETF remains 50% exposed to the stock market and 50% in short-term US Treasury Bills earning 5%. The allocation to the stock market comes from our trend discipline only. While the stock market remains in a bullish mood, we continue to participate partway in the gains. However, heeding accurate model forecasts that are only part way towards completing their full cycles has us watching the exit with one eye. For investors that seek to avoid large drawdowns, we suggest taking the right lessons from the best valuation models at our disposal. Better to learn from one error, than to make