“So I’ll meet you at the bottom, if there really is one

They always told me “When you hit it, you’ll know it”

But I’ve been falling so long, it’s like gravity’s gone

And I’m just floating,” Drive by Truckers

Interest rates fell steadily for decades. They were completely turned off between 2009 and 2021. Housing values soared. Cryptocurrency was created. GameStop “mooned.” Over the past year and a half, the Federal Funds Rate quickly rose from 0% to 5%+. Gravity has been turned back on, yet investors are still floating.

Stock market values remain elevated and continue to defy the bears, while the trends remain solidly positive. At times like this, I am glad I turned over my investment allocation decisions to an algorithm. My head wants to exit the US stock market entirely, my heart wants full exposure, our algorithm splits the difference with a 50% allocation. The other 50% earns 5%+ in risk-free US Treasuries.

Source MKAM ETF

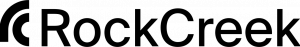

We currently remain in the yellow zone for markets, where investors can still participate, but should proceed with caution. The market was in the yellow zone 21% of the time in the modern post Greenspan era, according to our model. The trends remain 100% solid, while expected returns are below what we require to take the extra risk to be found in the stock market. This period does stand out from the past 15 years, however. Now, we can earn real interest while we wait for expected stock market returns to improve. We want to avoid entering the red zone when serious market drawdowns occur. We are not there yet, but we will keep you posted when we enter dangerous territory.

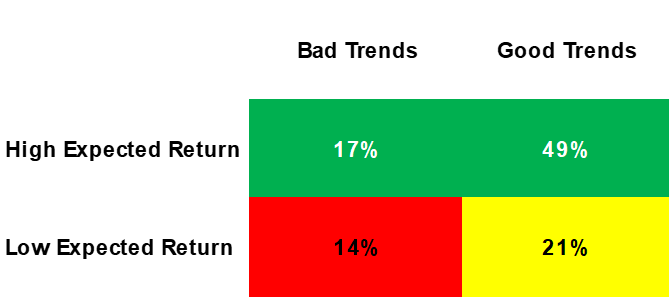

The US stock market remains too expensive according to all models with demonstrated predictive power. While US Treasury Bills now offer significantly more than their historical average and US Treasury bonds are about 20% shy of their long time average, stocks remain poised to deliver half of their historical returns. Yet, the stock market’s prospective standard deviation remains the same at 17% with higher odds of a large drawdown.

Source: MKAM ETF

Why would investors be content to accept mediocre stock returns when they can get the same guaranteed returns from the US Government in short-term bonds? We can strain to come up with some logical explanations. But we believe the best answer is simply inertia and emotions. It is very hard to sit out of a raging bull market that has been outperforming expectations for nearly 15 years. Each time the market falters, like falling 30%+ in Covid, and then recovers, it encourages investors to take more risk.

We imagine in time rationality will kick in and more investors will realize that we have left the world of ZIRP (zero interest rate policy) and TINA (there is no alternative) behind. That we are once again in a world of real interest rates, and gravity. After all, recently, the Bank of England surprised markets with a half point increase in their benchmark rate. And the Fed keeps telling everyone who will listen they intend to keep rates higher for longer.

When will the market switch from prioritizing emotions to rationality? Or switch from optimism to pessimism? We don’t have to wonder or worry. Every day, we simply check our algorithm.